Risk Management

Risk Management System

Recognizing that conducting proper risk management is an important management issue, we established the Risk Management Control Committee, chaired by the responsible executive officer and composed of representatives of related departments and Group companies, and are methodically moving forward with activities by regularly holding committee meetings.

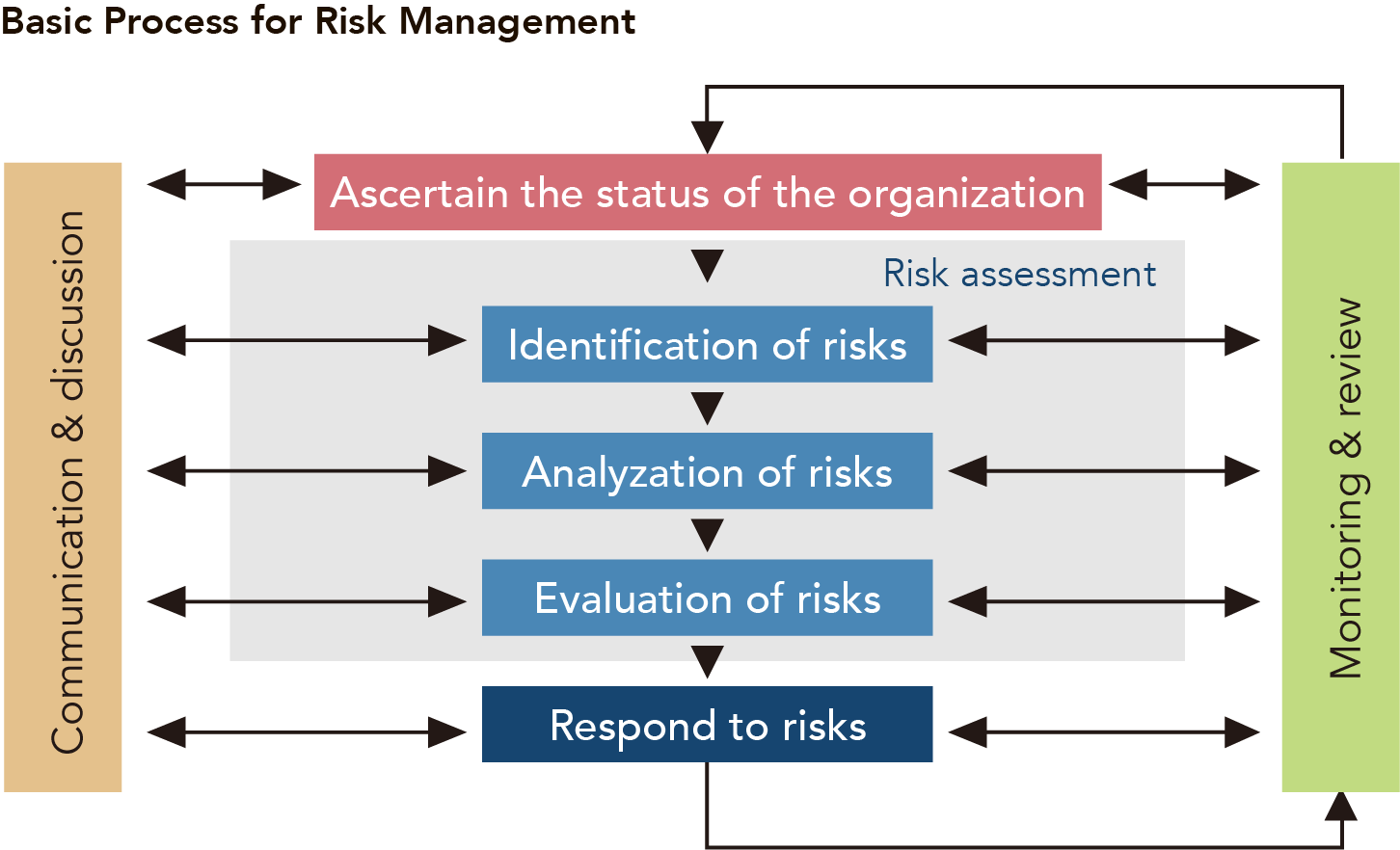

The purpose of the committee is to appropriately manage and implement responses to risk that could hinder achieving business objectives by running through the PDCA cycle, a basic risk management process (risk assessment, risk response, monitoring, and review).

In addition, we are working to maintain and strengthen the crisis management system so that when there is an emergency, we can promptly communicate information on risks, including to domestic and overseas Group companies, ascertain conditions, and appropriately respond. To deal with potential risks and/or risks that have already manifested themselves, we formulated Risk Management Procedures, Product Liability (PL) Prevention and Management Procedures, and Information Security Rules. We manage envisioned risks, such as natural disasters, pandemics, damage from terrorist attacks and deterioration in safety, leaks and environmental pollution, accidents that cause damage to facilities and equipment or result in physical harm, harm to society from problems such as product liability, security, and information management related to intellectual property, etc., by creating a list of these risks as actual reference examples and linking them to main in-house rules.

In fiscal 2021, based on revised risk management criteria, we identified and analyzed risks, selected ones based on an evaluation, and ranked their importance using a table based on degree of impact and frequency. For selected risks, the responsible party develops a response proposal, regularly checks, evaluates, and monitors the status of the response, and works to keep the risk within the tolerable range.

In addition, we worked to not only develop a business continuity plan in the case of an earthquake, an item that Group companies have not yet created, but also strengthen risk management. We also continue to conduct drills for earthquakes using a safety confirmation system.

Crisis Management

Having positioned implementing countermeasures to corporate risk as a priority issue, we set Risk Management Procedures to respond to potential risks and/or risks that have already manifested themselves. We created basic policies and a Risk Management Manual as supplementary material for conducting Risk Management Control Committee activities and managing corporate risks, and operate the system as stipulated in the Risk Management Procedures.

In the Risk Management Manual, we establish risk management levels and stipulate that the responsible person for the particular risk level is tasked with implementing risk management. Furthermore, for risks that impact lives and business, we are implementing and strengthening appropriate responses. There has been an upward trend in the frequency of earthquakes, water damage due to torrential rains, long heat waves, and natural disasters accompanying abnormal weather, such as massive snowstorms. To respond to the impact of these on business, we can promptly implement measures depending on the risk level by quickly sharing information with related parties using relevant tools.

| Risk Management Level | Responsible Party | Case | |

|---|---|---|---|

| Level I | Understanding risk possibilities under normal operation | Plant general managers, central branch managers, branch and office manag- ers, group company presidents | Natural disasters, terrorist attacks, civil unrest, environmental problems, acci- dents, information management |

| Level II | Risks to be coped with within plants, branches, offices and Group companies | Earthquakes (seismic intensity of 5 or more), environmental problems, acci- dents, nearby fires, typhoons, torrential rains, floods | |

| Level III | Risks to be coped with within departments (including Group companies) | Headquarters executive general managers, plant general managers, group company presidents | Damage from natural disaster, environ- mental problems, disease outbreak, product problems |

| Level IV | Risks to be coped with Company-wide | Head of Crisis Manage- ment Task Force (establish- ment of Crisis Management Task Force) | Expansion of Level II or Level III incident |

| Level V | Unexpected risks |