Climate Change Efforts

In March 2022, DKS pledged its commitment to the Task Force on Climate Related Financial Disclosures (TCFD), based on a recognition of how important the risks and opportunities of climate change are to our business. We will promote the disclosure of information regarding the impact that climate change has on the business activities of the Company, and aim to achieve a sustainable society by striving to realize a decarbonized society throughout the entire supply chain.

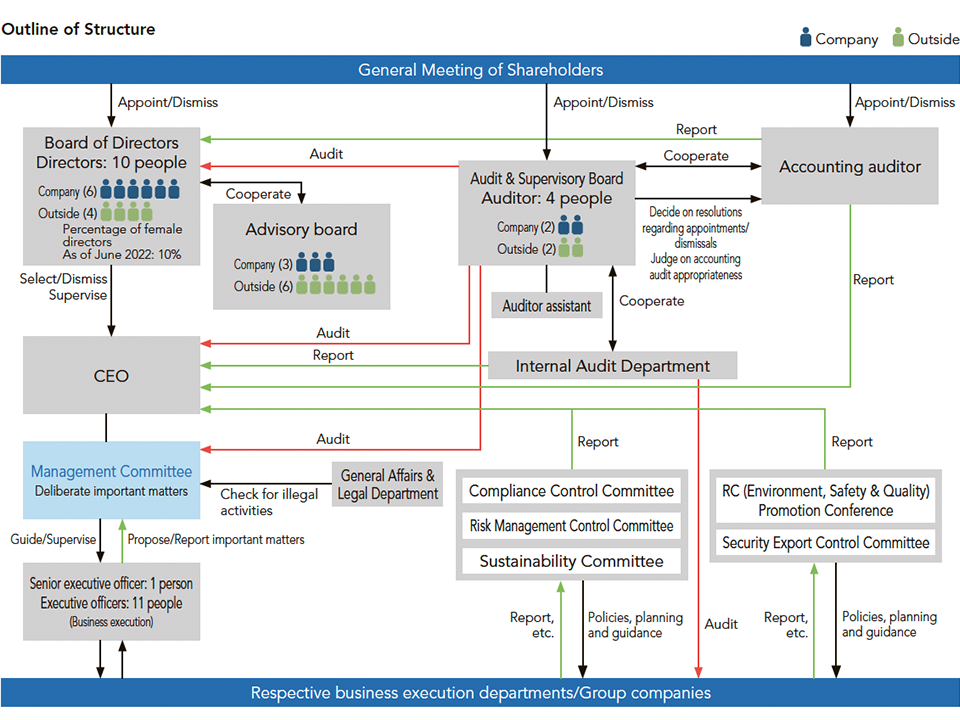

❶ Governance

At DKS, we have a Sustainability Committee that debates and makes decisions on important issues such as medium- to long-term targets for reducing greenhouse gas (GHG) emissions, and a system for ensuring appropriate reporting to the Board of Directors and supervision by the Board of Directors. In order to ensure that the Sustainability Committee appropriately evaluates and manages our business risks and opportunities related to climate change and promotes administration, the committee is made up of the Executive General Managers of the Sales Headquarters, Production Headquarters, R&D Headquarters, and Public & Investor Relations Department, and headed by the Executive General Manager of the Administrative Headquarters, who receives instructions from the Administrative Supervisor. The executive officers in charge submit findings and make progress reports at least once a year at Board of Directors meetings, and review strategies, targets, and plans accordingly.

❷ Strategy

Because the impact of climate change is highly likely to become apparent in the medium- to long-term, we are working on deepening our understanding of the major risks and opportunities related to climate change, which are expected to financially impact our business in the medium- to long-term. In regard to the evaluation of climate change risks and opportunities, we have referred to the climate change scenarios of the International Energy Agency (IEA) and Intergovernmental Panel on Climate Change (IPCC) to identify the risks and opportunities that will affect our entire business. While improving our understanding of the expected risks and opportunities from a medium- to long-term perspective, we will plan and execute strategies across a timeline.

Scenario Analysis

Presuppositions

- Climate change scenarios

- Less than 2 ˚C scenario, 4 ˚C scenario

- Reference scenarios

- IEA World Energy Outlook, IPCC RCP scenarios

- Timelines for analysis

- 2030, 2050

We categorize risks and opportunities related to climate change as transition risks, physical risks, transition opportunities, and physical opportunities, and have created a scenario matrix upon considering the level of occurrence and impact of each risk and opportunity.

Impact Evaluation Based on Scenario Analysis

Based on a scenario analysis, we have conducted an evaluation of the impact to our supply chain of scenarios with high importance.

| Category of climate change impact | Positioning in value chain | Scenario | Timeline | Details | Impact on the Company | Countermeasures taken by the Company |

|---|---|---|---|---|---|---|

| Transition | Impact on demand for products and services | Changes to demand toward decarbonization | 2030 to 2050 | Sales and profit may greatly decline if demand for petrochemical derived products declines | Business with a high ratio of petrochemical derived materials may gradually decline |

|

| Transition | Impact on demand for products and services | Increased costs due to carbon pricing | 2030 to 2050 | Emission credit trading may increase as a measure for reducing GHG emissions and lead to higher transaction prices | Operating income in 2030 may decrease by several percentage points |

|

| Transition | Impact on procurement | Increased taxes with a carbon tax on raw materials | 2030 to 2050 | The procurement price of materials may increase due to a carbon tax on materials derived from petrochemicals | The profitability of businesses which focus on materials derived from petrochemicals may gradually decline |

|

| Physical | Direct impacts on business operation | Increased damage to company sites due to intensifying natural disasters | 2050 | Business site disasters (mainly flooding) caused by abnormal weather may cause business operations to stop | May cause damage to approximately 10% of our total plant assets in Japan |

|

Efforts after Scenario Analysis

Upon conducting a scenario analysis, we reaffirmed that it is possible to reduce impact on our supply chains by appropriately responding to climate change risks. Our products and technologies give us an opportunity to expand our business by identifying new market needs for climate change countermeasures. We will meet market needs by promoting research and development for contributing to society’s efforts for climate change countermeasures and mitigating the progression of climate change related risks, such as with products that contribute to energy-saving by shortening manufacturing processes and products that contribute to the realization of clean energy for preventing global warming.

| Market needs | Value provided | DKS technologies and products |

|---|---|---|

| Energy and resource saving | Saving energy by shortening manufacturing processes | Solvent-free UV-curable materials |

| Preventing product deterioration | Polyurethane resin sealants for electric insulation | |

| Preventing global warming | Achieving clean energy | Binder for lithium-ion batteries, gel electrolyte polymers, conductive paste for solar cells |

| Reducing greenhouse gas emissions | Alternative cleaning agents avoiding ethane and chlorofluorocarbon solvents |

❸ Risk Management

In regard to overall risk management at DKS, we systematically promote activities by periodically holding Risk Management Control Committee meetings attended by representatives of subsidiaries and each department, and headed by an executive officer in charge of risk management.

❹ Indices and Targets

We have defined our long-term goals, including consolidated net sales of ¥135 billion and the reduction of greenhouse gas emissions, in a new management plan for the year 2030, called “SMART 2030 (tentative title).” The process for achieving our long-term goals involves creating a medium-term environmental plan for the years up to fiscal 2024 based on the “FELIZ 115” medium-term management plan, and working to save energy, reduce greenhouse gas emissions, and reduce waste. We have also formulated long-term green transformation (GX) strategies that aim to achieve carbon neutrality by the year 2050, and are promoting efforts for decarbonization. In the future, we will work to identify the Scope 3 greenhouse gas emissions of our supply chain, quickly disclose this information, and strive to reduce our emissions.

Target

Reducing the Scope 1 and Scope 2 greenhouse gas emissions of the entire DKS Group in Japan by 30% by fiscal 2030, compared to fiscal 2013